Taking a Loan Against Property (LAP) is one of the most cost-effective ways for farmers, agribusiness owners, MSMEs and SMEs to access large amounts of working capital. But many applicants lose time, money, or approval chances because they stumble over basic checks when assessing a loan against property eligibility. Below are 5 common mistakes and how to avoid them, so your application (and your business) stays on track.

Quick market snapshot: Why this matters?

The Indian loan against property market size reached USD 758.00 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2,369.36 Billion by 2033, exhibiting a growth rate (CAGR) of 13.50% during 2025-2033. This growth means more lenders, more products, and more reasons to check eligibility carefully.

Mistake 1: Relying on a single rough EMI estimate

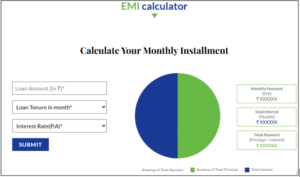

Many borrowers start with a vague monthly payment idea and proceed to apply. Using an accurate loan against property EMI calculator is essential because EMI, tenure, and interest rate determine affordability and LTV (loan-to-value) decisions. Free calculators that let you change interest rate, tenure and loan amount will show whether your cash flows truly support the loan. Agriwise offers a dedicated EMI calculator tailored for LAP customers. Use it before you apply to avoid surprises!

Fix: Run multiple scenarios on a loan against property EMI calculator (different tenures and rates) and save the outputs to share with your relationship manager.

Mistake 2: Ignoring the precise eligibility inputs

“Am I eligible?” is too broad. Lenders evaluate multiple variables — credit score, income, property type (residential/commercial/industrial), clear title, and age of the property. Don’t assume you’ll qualify because you own land. Use a loan against property eligibility calculator to get a data-driven read on likely outcomes. Remember that eligibility criteria for loan against property can differ widely between banks and NBFCs, especially for agricultural/ rural properties.

Fix: Collect documents (title deed, latest property tax receipt, income proofs, bank statements) and feed accurate numbers into a loan against property eligibility calculator before applying. Agriwise’s LAP guides agri-clients through property doc checks and provides an easy eligibility check process.

Mistake 3: Overestimating the property valuation or LTV

A common misstep is assuming a lender will accept the market value you see on listing sites or broker quotes. Lenders perform independent valuations and often offer conservative LTVs of 40–70%, depending on the property and lender risk. Assuming a higher LTV can leave you short of the funds you are expected to have.

Fix: Ask prospective lenders for indicative LTV ranges and plan financing with conservative figures. Use your LAP loan EMI calculator with the lower loan amount to test affordability if LTV is reduced.

Mistake 4: Underestimating the impact of credit score and debt profile

The macro trend shows household debt rising and more formal loans being sanctioned through fintechs and NBFCs — meaning underwriting is getting data-driven and stricter in certain pockets. A weak credit history or multiple recent loans can increase your interest rate or reduce sanction amount. Don’t assume secured lending removes all credit scrutiny.

Fix: Pull your credit report, correct errors, and reduce outstanding high-cost unsecured debt before applying. If you need a lender who understands agri cash flow cycles, Agriwise’s LAP team often structures repayments aligned with crop cycles and cash inflows.

Mistake 5: Overlooking total costs beyond the EMI

EMI is just one part of the cost. Processing fees, valuation fees, legal charges, insurance, pre-payment penalties, and GST can add materially to borrowing costs. Comparing only the headline rate (or only the EMI) can mislead you into choosing a more expensive option.

Fix: Use a loan against property EMI calculator that allows you to add fees, or keep a separate fees worksheet. Ask lenders for a full break-up of charges and compute the effective cost. Agriwise’s platform provides a transparent fee summary alongside the EMI output so agribusiness customers can compare offers quickly.

Final checklist before you apply

- Run multiple scenarios on an accurate LAP loan EMI calculator and an eligibility calculator.

- Gather title documents and income proofs in advance.

- Confirm the likely LTV and valuation process with the lender.

- Clean up your credit profile and consolidate high-cost debt.

- Compare total costs (fees + EMI), not just headline interest.

Why choose Agriwise for LAP checks?

Agriwise combines agri-sector expertise with tailored LAP solutions for farmers and agribusinesses. Their LAP offering understands seasonal cash flows and typical rural property documentation, and their online EMI calculator (explicitly designed for LAP customers) helps you model realistic EMIs quickly. Use Agriwise to run both your EMI scenarios and a guided eligibility check before you approach banks or NBFCs.

Staying methodical when checking a loan against property eligibility saves time, reduces costs, and increases your chance of approval. Run the right calculators, validate documents, and work with an agri-savvy lender like Agriwise, and your LAP will become a working-capital tool rather than an unexpected burden.

FAQs

- What is loan against property eligibility, and why is it important?

Loan Against Property (LAP) eligibility refers to the set of criteria that a borrower must meet to qualify for a loan by pledging their residential, commercial, or industrial property as collateral. These criteria may include the borrower’s income, credit score, repayment capacity, property value, property title clarity, and overall financial profile. - How can I check my loan against property eligibility accurately?

The easiest way is to use a loan against property eligibility calculator. It evaluates factors like income, current EMIs, and property value to give a quick indication of your eligibility. Agriwise also guides applicants through document checks for accurate results. - Which tools help me estimate EMIs before applying for a LAP?

You can use a loan against property emi calculator or a LAP loan emi calculator to estimate monthly payments based on interest rate, loan amount, and tenure. Agriwise offers a simple online EMI calculator designed specifically for LAP customers. - What documents do I need to meet the eligibility criteria for a loan against property?

Typically, you need property papers (clear title deed), ID & address proof, bank statements, income documents, and latest property tax receipts. Lenders may ask for additional paperwork depending on the property and loan profile. - How does Agriwise help improve my chances of LAP approval?

Agriwise provides a transparent eligibility-check flow, assists with property and income documentation, and offers customised LAP solutions suited to agricultural and rural borrowers. Its online EMI calculator also helps you fine-tune the right loan and repayment plan before applying.

Disclaimer

The content published on this blog is provided solely for informational and educational purposes and is not intended as professional or legal advice. While we strive to ensure the accuracy and reliability of the information presented, Agriwise make no representations or warranties of any kind, express or implied, about the completeness, accuracy, suitability, or availability with respect to the blog content or the information, products, services, or related graphics contained in the blog for any purpose. Any reliance you place on such information is therefore strictly at your own risk. Readers are encouraged to consult qualified agricultural experts, agronomists, or relevant professionals before making any decisions based on the information provided herein. Agriwise, its authors, contributors, and affiliates shall not be held liable for any loss or damage, including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from reliance on information contained in this blog. Through this blog, you may be able to link to other websites that are not under the control of Agriwise. We have no control over the nature, content, and availability of those sites and inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them. We reserve the right to modify, update, or remove blog content at any time without prior notice.