Agriculture and MSMEs across India are turning to renewable energy to cut costs, increase productivity, and achieve sustainability. A solar loan allows farmers and small businesses to invest in solar energy systems—like rooftop solar, irrigation pumps, and other installations—without the hefty upfront cost. Thanks to favorable interest rates, subsidies, and flexible repayment structures, these solar loans are reshaping the financial landscape for agriculture and MSMEs in 2025.

Why choose a solar loan?

- Huge cost savings: With rising electricity tariffs and unpredictable diesel prices, switching to solar via a solar loan can slash monthly energy bills by nearly half for farms and businesses.

- Access to subsidies and schemes: Government-backed Solar Loan Schemes in India—such as the Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan (PM-KUSUM)—offer attractive subsidies for farmers installing solar pumps. Likewise, MSMEs can access Solar Loan Subsidy India programs for rooftop and off-grid solar systems.

- Rapid return on investment: The payback period often ranges from 3 to 5 years thanks to lower utility costs and high solar irradiation, especially in regions like central and southern India.

Types of solar loans available

- Solar loans for agriculture: Agricultural producers can finance solar-powered irrigation systems through the solar irrigation pump loan. These loans are frequently bundled with schemes like PM-KUSUM and other agricultural solar financing initiatives. Farmers benefit from subsidized interest rates and better loan terms under solar loan scheme India offerings.

- Solar loan for farmers India: Specifically tailored for India’s farming community, these packages support installation of solar arrays to power operations—reducing dependence on grid electricity and diesel. The combination of subsidy, credit-linked support, and financing makes farmers solar loan India an attractive option.

- MSME solar loan & solar financing MSME: Small enterprises can access MSME solar loan or solar financing MSME products to install rooftop or ground-mounted solar systems. Financing terms typically cover up to 90% of project costs, with loans spread over 7–10 years. Businesses can use this to lighten their electricity burden and enhance profitability.

- Rooftop solar loans & solar panel loan India: Rooftop solar adoption is soaring—and rooftop system loans powered by solar panel loan India or solar power loan India make installation more affordable. These loans help businesses and households structure payments that align with lower electricity bills, making clean energy installations more accessible.

Industry figures in 2025

As of April 2025, India’s installed solar capacity stands at 107.94 GW_AC, generating 144 TWh of electricity—up from 116 TWh in 2024. The National Solar Mission target of 100 GW was surpassed in January 2025. For agriculture, the RBI raised the collateral-free loan limit from ₹1.6 lakh to ₹2 lakh to improve access to credit.

On the household front, the Pradhan Mantri Surya Ghar Muft Bijli Yojana, launched in 2024 with a budget of ₹75,021 crore, will provide 1 crore households with rooftop solar and 300 free units of electricity per month. In addition, collateral-free rooftop loans up to ₹2 lakh at a subsidized 6.75% interest rate are available for systems up to 3 kW. Finally, the GST on solar devices has been cut from 12% to 5%, lowering project costs by nearly 5%.

Agriwise solar loans

When it comes to tailored financial support, Agriwise loans are designed with the farming and MSME ecosystem in mind. For solar loans, we offer:

- Competitive interest rates

- Flexible repayment terms up to 10 years

- Assistance with subsidy processing, including PM-KUSUM and state schemes

- Expert guidance on required approvals, vendor selection, and installation monitoring

Whether you’re a farmer seeking a solar irrigation pump loan, or an MSME looking for a rooftop solar loan, Agriwise ensures that you get the best match between financing, subsidy, and delivery. Our streamlined process saves you both time and effort—so you can concentrate on cultivating growth.

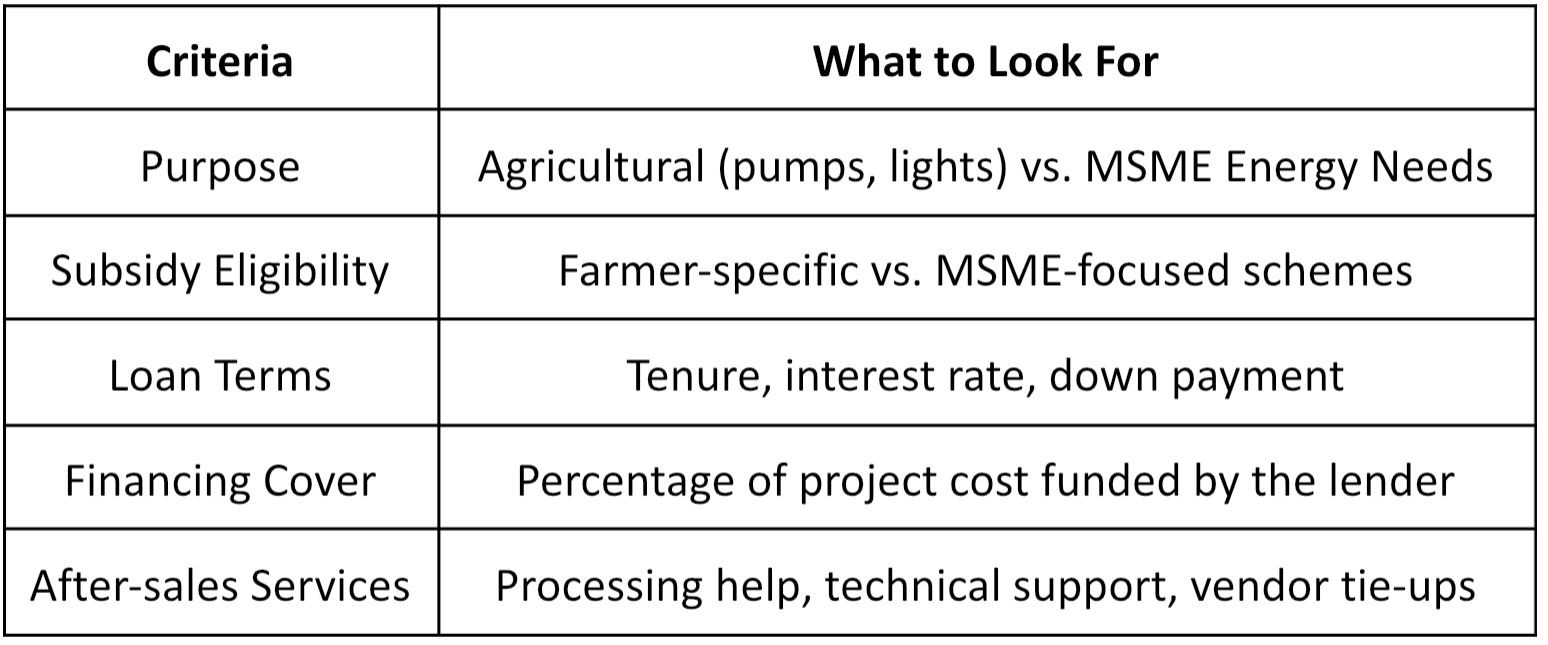

How to choose the right solar loan option?

Conclusion: Pay less, save more

A solar loan provides a powerful lever to pay less for energy and save more for your enterprise—whether you’re a farmer leveraging farmers solar loan India or a small business financing rooftop arrays through MSME solar loan programs. With the aid of solar loan MSME India, solar loan scheme India, and solar loan subsidy India, investing in solar has never been more financially prudent.

Let Agriwise guide you through agricultural solar financing and ensure you seize the full potential of solar loan for farmers India or solar financing MSME offerings. Going solar is not just an environmentally smart move—it’s a financially savvy strategy for long-term prosperity.

Disclaimer

The content published on this blog is provided solely for informational and educational purposes and is not intended as professional or legal advice. While we strive to ensure the accuracy and reliability of the information presented, Agriwise make no representations or warranties of any kind, express or implied, about the completeness, accuracy, suitability, or availability with respect to the blog content or the information, products, services, or related graphics contained in the blog for any purpose. Any reliance you place on such information is therefore strictly at your own risk. Readers are encouraged to consult qualified agricultural experts, agronomists, or relevant professionals before making any decisions based on the information provided herein. Agriwise, its authors, contributors, and affiliates shall not be held liable for any loss or damage, including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from reliance on information contained in this blog. Through this blog, you may be able to link to other websites that are not under the control of Agriwise. We have no control over the nature, content, and availability of those sites and inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them. We reserve the right to modify, update, or remove blog content at any time without prior notice.