For agribusinesses seeking capital without compromising operational liquidity, a loan against property (LAP loan) offers a compelling solution. An agri LAP loan leverages your existing property—be it farmland, warehouse, or residential premises—to raise funds, typically at lower interest rates than unsecured credit. For those in the agriculture sector, LAP for farmers/agribusiness bridges the gap between capital needs and formal credit access, especially in the face of rising input/raw material costs. At Agriwise Finserv, we specialize in customized LAP loans for agribusinesses, offering higher loan amounts, longer tenures, and simplified processes tailored to the unique cycles of agriculture.

Current landscape & why an agri LAP loan makes sense?

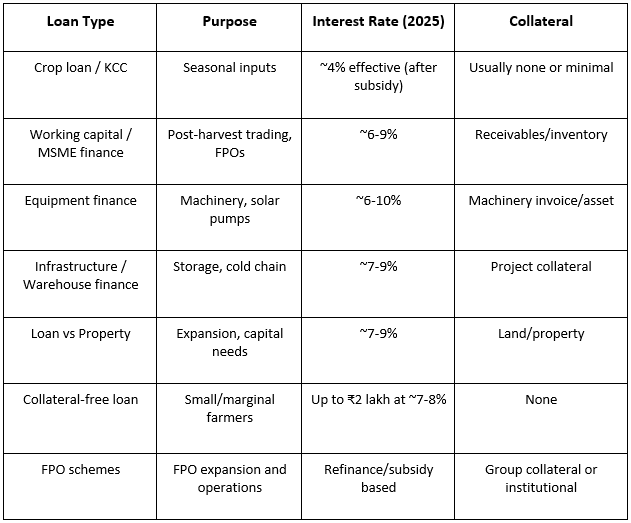

In 2025, the average agriculture loan interest rate in India stands at approximately 8.2% per annum—a decline from around 8.7% in 2023—thanks to interest subvention schemes that lower effective rates to as little as 4% for prompt repayment. These favourable terms make securing an LAP loan especially attractive for agribusinesses looking for long-term funding.

On the micro-lending end, the cooperative government in Maharashtra has capped private moneylenders’ interest rates at 9% p.a. for secured agricultural loans, reinforcing the advantage of formal borrowing routes such as agri LAP loans. Moreover, MSME loan portfolios remained robust in FY25, with portfolios at risk (PAR) in the 31–90 day bucket at just 1.7%, highlighting the relative safety and reliability of structured, collateral-backed financing such as LAP.

Step-by-Step Guide: How to secure an LAP loan for your agribusiness

1. Assess your eligibility and property value

The first step is to evaluate whether you qualify for an LAP loan. Lenders usually consider the type of property, its current market value, and your repayment capacity. The loan amount is generally a percentage of the property’s value, often between 60–70%. Farmers and agribusinesses should begin by gathering valuation details of their property such as residential, commercial or industrial.

2. Understand the terms of the loan

Before applying, understand the basics: expected loan amount, interest rates, tenure, and repayment flexibility. Agri LAP loans typically come with longer repayment tenures (up to 15 years), making them suitable for businesses with seasonal income cycles. Knowing the terms upfront ensures you borrow wisely and avoid unnecessary strain later.

3. Prepare the required documentation

Documentation is crucial for approval. Generally required papers include proof of property ownership, identity proof, financial statements, and in some cases, details of the agribusiness operations. Preparing accurate documents in advance reduces processing delays and increases the chances of a smooth approval process.

4. Apply through a trusted channel

Once prepared, you can submit your application either offline or through digital platforms. This is where Agriwise adds value—its technology-driven platform guides farmers and agribusiness owners through the application process, ensuring eligibility checks, quick submission, and hassle-free communication with lenders. By doing so, Agriwise helps applicants save time and avoid common errors.

5. Plan the utilisation of the loan

After approval, it is important to use the loan against property strategically. Funds can be allocated toward expanding storage facilities, purchasing farm equipment, or maintaining steady cash flow during crop cycles. Agriwise also provides advisory support to help borrowers align the loan with their business goals and repayment capacity.

Advantages of choosing an agri LAP loan through Agriwise

- Lower interest costs compared to unsecured or informal credit

- Longer tenures, up to 15 years, mitigating EMI pressures

- Higher LTV, preserving capital for other needs

- Formal, regulated lending environment, reducing risk of predatory terms

- Less documentation & BT with top-up loan option available

This makes an LAP loan a strategic instrument for building resilience in your agribusiness.

Conclusion

Securing an LAP loan for your agribusiness is not just about unlocking capital—it’s about choosing a sustainable, cost-effective financing structure that aligns with long-term productivity goals. With competitive rates of interest and supportive platforms like Agriwise streamlining access, now is an ideal time to explore agri LAP loans.

Let Agriwise help you navigate the journey—from eligibility and documentation to approval and strategic utilization. When structured right, a loan against property can be the growth catalyst your agribusiness needs—secure, efficient, and attuned to the pulse of Indian agriculture.

Disclaimer

The content published on this blog is provided solely for informational and educational purposes and is not intended as professional or legal advice. While we strive to ensure the accuracy and reliability of the information presented, Agriwise make no representations or warranties of any kind, express or implied, about the completeness, accuracy, suitability, or availability with respect to the blog content or the information, products, services, or related graphics contained in the blog for any purpose. Any reliance you place on such information is therefore strictly at your own risk. Readers are encouraged to consult qualified agricultural experts, agronomists, or relevant professionals before making any decisions based on the information provided herein. Agriwise, its authors, contributors, and affiliates shall not be held liable for any loss or damage, including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from reliance on information contained in this blog. Through this blog, you may be able to link to other websites that are not under the control of Agriwise. We have no control over the nature, content, and availability of those sites and inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them. We reserve the right to modify, update, or remove blog content at any time without prior notice.