In 2025, securing the right agriculture loan will be crucial for Indian farmers to thrive. From crop loan schemes to MSME finance, solar loan for farmers, and agri business loan options, this guide from Agriwise helps you navigate the best agriculture loan options in India.

Agriculture loan landscape: Key figures & trends

In FY 2024‑25, formal farm credit in India rose to ₹28.98 lakh crore, with projections to exceed ₹31.5 lakh crore in FY 2025‑26—over ₹32 lakh crore per NABARD forecasts. Over 60% of this is short-term crop loan schemes financing seasonal needs, with the rest supporting investment in machinery, infrastructure, and allied sectors. In addition, short-term credit has nearly doubled since 2014‑15, and the share of small and marginal farmers accessing agriculture loans has grown to 76% in 2023‑24 according to PIB.

As per Farmonaut, projected average agriculture loan interest rate in India for 2025 is approximately 8.2% p.a.—down from around 8.7% in 2023—with effective rates as low as 4% for prompt repayment under interest subvention schemes.

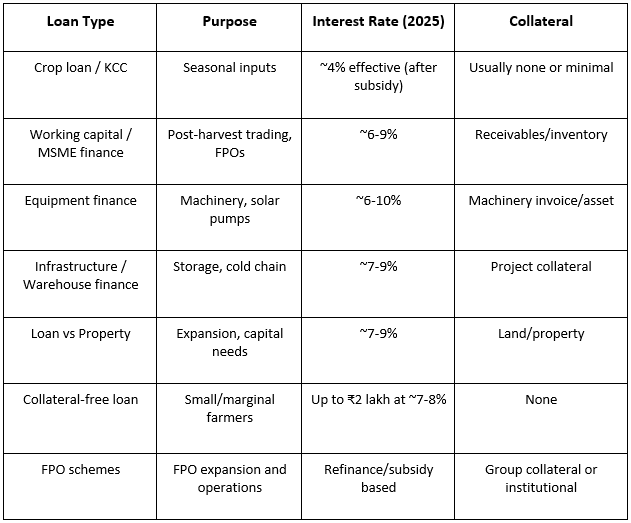

Top Types of Agriculture Loan Options

- Crop loan schemes / Farmer loan 2025: Under NABARD–GoI interest subvention, crop loans up to ₹3 lakh are extended at 7% nominal interest, and farmers repaying promptly may get an extra 3% discount—bringing the effective rate to just 4%. Kisan Credit Cards (KCC) provide working capital credit for seeds, fertilisers, labour, with repayment aligned to harvest cycles. These are top agri finance tools for short‑term needs.

- Farm equipment finance & Agri business loan: Long‑term farm equipment finance supports buying tractors, drip irrigation, solar pumps, or machinery—with tenures of 3–7 years and interest rates in the range of 6%–10% depending on collateral and green technology focus. For larger ventures, agri business loan options are available from banks like HDFC or ICICI with rates from 9%–11%, requiring business plans and a bit of collateral.

- Agri‑infra, warehouse finance & working capital loan for farmers: Under NABARD’s AMI sub-scheme, a credit-linked facility offers a subsidy of 25–33% for projects such as warehouses, cold-storage, and market infrastructure—supported via warehouse finance options for small and medium-scale infrastructure borrowers. Working capital loan for farmers via MSME credit lines help with post‑harvest costs, sorting, packaging, or distribution.

- Collateral‑free agri loan & MSME loan for agriculture: Thanks to RBI’s policy, small and marginal farmers can access collateral free agri loan up to ₹2 lakh (recently raised from ₹1.6 lakh), via banks or small finance banks. For agri‑based micro, small and medium enterprises like FPOs or food‑processing firms, MSME loan for agriculture and invoice discounting for agri MSMEs provide credit tied to receivables and inventory. NABARD’s NABSAMRUDDHI and NABKISAN schemes support MSME finance and FPO loan schemes with targeted support.

- Loan against property for farmers & solar loan for farmers: Term loans backed by real estate—loan against property for farmers—are available at 7‑9% interest rates, supporting working capital or expansion. Similarly, solar loan for farmers helps install solar pumps or panels, often with concessional rates and refinance support from NABARD, aiming to reduce energy costs and promote sustainability.

- FPO loan scheme & government loan for farmers: NABARD and government‑backed FPO loan scheme targets Farmer Producer Organisations, giving upto 100% refinance and grant support. Various state governments—e.g., UP’s Rs 5,000 crore subsidised scheme—provide government loan for farmers with special interest subsidies (~3%) to modernise cold storage and farm infrastructure.

Choosing the Right Agriculture Loan in 2025

Role of NABARD schemes 2025 & Agriwise services

NABARD Schemes 2025 such as STCRC, LTRCF, AMI sub‑scheme, dairy lending, KCC refinance and agro‑infrastructure refinance underpin most agriculture loan options—ensuring subsidised rates, refinance support, and grants.

At Agriwise, we offer end‑to‑end assistance in identifying the best loan for farmers in India—from applying for KCC crop loans, MSME loan for agriculture, FPO loan scheme, solar loans, and connecting you with lenders offering farm equipment finance, collateral‑free options, working capital loans, or even loan against property. We help you compare by interest rate, tenure, and eligibility to ensure you get the optimal credit solution.

Tips to Secure Best Agriculture Loan 2025

- Choose the right category—short‑term crop loan, MSME finance, solar loan, infrastructure, etc.

- Repay promptly to access better agriculture loan interest rate such as the 3% prompt repayment incentive.

- Join JLGs (Joint Liability Groups) or FPOs for easier access to collateral‑free or group‑supported loans.

- Use bankable business plans for agri business loan or equipment finance.

- Access government or NABARD schemes via Agriwise to streamline application and documentation.

Conclusion

In 2025, agriculture loan options in India span crop loans, working capital, equipment finance, agri‑infrastructure support, solar financing, collateral‑free credit, and FPO/MSME schemes. Interest rates range from as low as 4% for crop loans to around 9‑11% for business/investment loans, powered by government and NABARD interventions. With over ₹31–32 lakh crore in total farm credit expected in FY 2025‑26, farmers have unprecedented access to formal credit channels.

Whether you’re a smallholder seeking collateral-free agri loan, an FPO exploring invoice discounting for agri MSMEs, or a solar‑pump owner evaluating a solar loan for farmers, Agriwise can guide you through the process—from matching schemes to application support. Maximise your productivity and growth with the best agriculture loan strategy to empower your farming future.

Disclaimer

The content published on this blog is provided solely for informational and educational purposes and is not intended as professional or legal advice. While we strive to ensure the accuracy and reliability of the information presented, Agriwise make no representations or warranties of any kind, express or implied, about the completeness, accuracy, suitability, or availability with respect to the blog content or the information, products, services, or related graphics contained in the blog for any purpose. Any reliance you place on such information is therefore strictly at your own risk. Readers are encouraged to consult qualified agricultural experts, agronomists, or relevant professionals before making any decisions based on the information provided herein. Agriwise, its authors, contributors, and affiliates shall not be held liable for any loss or damage, including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from reliance on information contained in this blog. Through this blog, you may be able to link to other websites that are not under the control of Agriwise. We have no control over the nature, content, and availability of those sites and inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them. We reserve the right to modify, update, or remove blog content at any time without prior notice.