Choosing the right agri finance partner can shape the entire farming journey from timely sowing to profitable harvesting. As of 2025, India’s agricultural credit ecosystem has grown significantly, with institutional farm credit crossing ₹18 lakh crore annually and Kisan Credit Card (KCC) coverage extending to over 7.7 crore farmers. With more formal lenders entering rural markets, farmers now have options, but the right choice depends on careful evaluation.

But the question is, what should farmers assess before selecting an agri finance partner? How specialised institutions like Agriwise simplify access to structured, farmer-first financial solutions?

The best finance partner for farmers does more than disburse funds. It aligns financial products with crop cycles, input needs, market volatility and long-term farm sustainability. With rising input costs, increased demand for mechanisation, and climate-linked risks, the need for customised financing is stronger than ever. Farmers should look for partners who understand agricultural seasonality, offer flexible repayment structures, and support them through the entire credit lifecycle, not just at disbursement.

Key factors to check before selecting the right agri finance partner

- Sector expertise and agricultural understanding: Your finance partner should have proven experience in agricultural lending. This includes familiarity with crop cycles, regional risks, MSP trends, price volatility and post-harvest realities. Institutions specialising in agri finance are better equipped to evaluate farm-level risk and provide context-specific loan solutions.

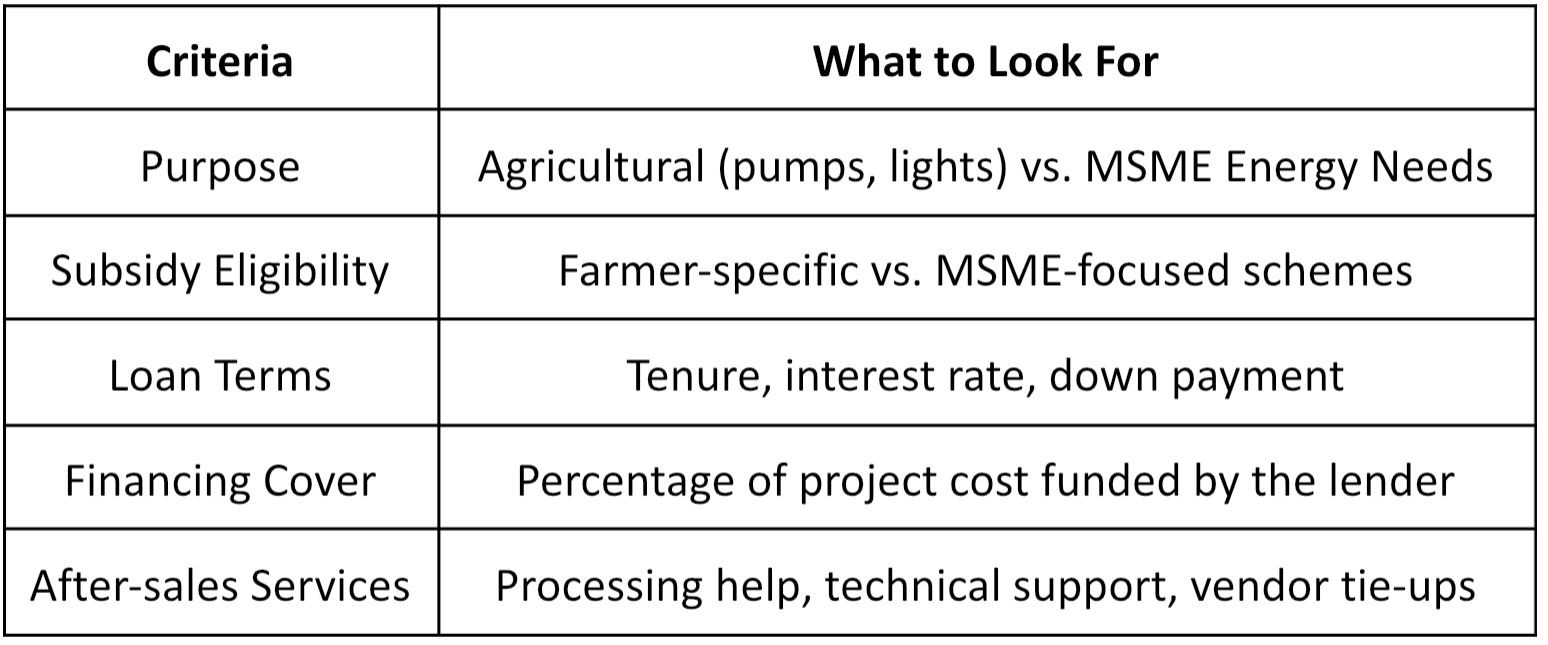

- Range of financial products offered: A dependable agri finance partner should provide diversified loan options catering to different farm needs, including:

- Short-term working capital

- Equipment and infrastructure loans

- Crop cultivation financing

- Post-harvest and storage-linked credit

This is where Agriwise stands out as an agri-focused NBFC offering tailored solutions such as:

-

- Warehouse Receipt Finance – Enables farmers to unlock liquidity by using stored produce as collateral, helping them avoid distress sales.

- Loan Against Property (Agri LAP) – Supports larger funding requirements for agri expansion, infrastructure, or diversification.

- Solar Finance – Helps farmers adopt renewable energy solutions, reducing operational costs and increasing sustainability.

- Invoice Discounting / Supply Chain Finance – Provides working capital support to agri MSMEs and farmers dealing with bulk buyers and aggregators.

- Transparency in cost and terms: Every farmer should clearly understand the total borrowing cost. Before finalising your partner, ensure transparency in:

- Interest rates

- Processing fees

- Prepayment charges

- Insurance premiums

- Penal clauses

Ask for a complete repayment schedule and an effective annual cost breakdown. A transparent partner builds long-term trust and enables better financial planning.

- Speed and timing of disbursement: Agriculture is time-sensitive. Delayed funding can disrupt sowing or harvest plans. A good agri finance partner ensures quick processing, simplified documentation, and digitally enabled approvals so funds reach farmers exactly when needed. Leading agri finance institutions now leverage alternative data, satellite insights, and transaction histories to accelerate credit decisions while maintaining strong compliance.

- Collateral flexibility and security options: Not all farmers prefer land-based collateral. Modern agri finance partners provide alternatives such as warehouse receipts, invoice-backed loans or asset-based lending. Understanding evaluation processes, stock inspection norms and release terms is critical to avoid future bottlenecks.

Agriwise’s Warehouse Receipt Finance model enables farmers to use stored produce as security, ensuring better price realisation and liquidity management.

- Integration with risk mitigation tools: A strong finance partner integrates insurance solutions, crop covers and advisory services to mitigate risks. This includes guidance on crop insurance, credit protection products and emergency support during unforeseen events like climate shocks or market disruptions.

- Digital accessibility and farmer support: Look for finance partners offering mobile-based loan tracking, multilingual support, real-time alerts and local field assistance. These features reduce reliance on paperwork and make financial management more farmer-friendly.

Agriwise combines financial services with farmer-centric support, ensuring simplified access and continuous guidance throughout the loan lifecycle. - Compliance and credibility: Always verify that your finance partner follows RBI and NBFC regulatory standards, maintains grievance redressal mechanisms and has a credible operating history. This ensures stability and accountability of your financial engagement.

Why Agriwise is a reliable agri finance partner for farmers?

Agriwise is part of the StarAgri Group, one of India’s leading agri-service providers with warehousing, collateral management, and market linkage expertise. This allows Agriwise to understand farmers’ real challenges and offer practical financial solutions tailored to their needs.

Agriwise focuses on empowering farmers and agri MSMEs by improving access to structured credit. Its offerings are designed to bridge the gap between formal finance and on-ground agricultural needs. By combining technology-driven credit assessment with sector expertise, Agriwise ensures that farmers receive customised financial solutions across cultivation, storage and expansion stages.

As a specialised agri finance partner, Agriwise supports smoother cash flow, enables infrastructure investment and promotes sustainable farming practices through renewable energy financing. Agriwise has dedicated RMs, periodic follow-ups, and grievance resolution to ensure farmers receive continuous support throughout the loan cycle.

Final words

Selecting the right agri finance partner is a strategic decision that impacts profitability, resilience and long-term farm growth. With India’s agricultural financing ecosystem evolving rapidly, farmers now have the opportunity to align with partners who offer transparency, flexibility and agricultural understanding.

Whether you need funding for crop cycles, solar adoption, storage or expansion, the right finance partner will act as a growth enabler — not just a lender. By evaluating expertise, product diversity and service quality, farmers can secure financial stability and drive sustainable agricultural success.

FAQs:

- What type of loan is best for small farmers?

Small farmers usually benefit from short-term working capital loans such as KCC or crop cultivation finance. These offer flexible repayment aligned with seasonal income. - How can farmers reduce the cost of borrowing?

Farmers can lower costs by choosing interest subvention schemes, maintaining good repayment history and comparing total loan costs across finance partners. Transparency in fees also helps avoid hidden charges. - What documents are required to apply with a finance partner?

Basic documents include Aadhaar, PAN, land records or lease papers, bank statements and crop details. Some loans may also require warehouse receipts or proof of income. - Is warehouse receipt finance suitable for seasonal crops?

Yes, it allows farmers to pledge stored produce and access funds without selling at low post-harvest prices, supporting better cash flow management. - How do I know if a finance partner is trustworthy and RBI-compliant?

Check if the lender is RBI-registered, offers transparent terms and has a clear grievance process. A strong track record in agri-lending is also a good indicator. - Can farmers apply for multiple types of loans simultaneously?

Yes, multiple loans are possible if repayment capacity allows. A responsible finance partner will assess overall exposure for sustainable borrowing.

Disclaimer

The content published on this blog is provided solely for informational and educational purposes and is not intended as professional or legal advice. While we strive to ensure the accuracy and reliability of the information presented, Agriwise make no representations or warranties of any kind, express or implied, about the completeness, accuracy, suitability, or availability with respect to the blog content or the information, products, services, or related graphics contained in the blog for any purpose. Any reliance you place on such information is therefore strictly at your own risk. Readers are encouraged to consult qualified agricultural experts, agronomists, or relevant professionals before making any decisions based on the information provided herein. Agriwise, its authors, contributors, and affiliates shall not be held liable for any loss or damage, including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from reliance on information contained in this blog. Through this blog, you may be able to link to other websites that are not under the control of Agriwise. We have no control over the nature, content, and availability of those sites and inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them. We reserve the right to modify, update, or remove blog content at any time without prior notice.