Access to reliable rural credit is vital for India’s agricultural productivity, rural livelihoods, and inclusive growth. In areas where commercial banks are scarce, Non-Bank Financial Companies (NBFCs) are rapidly emerging as critical providers of credit, adapting their models to meet the unique challenges of remote and small-scale borrowers.

Why NBFCs matter for rural credit?

NBFCs offer flexibility, speed, and product innovation tailored to the needs of farmers and rural micro-entrepreneurs. Because of their lighter infrastructure and ability to work through field agents, partner organisations (such as Farmer Producer Organisations or Self Help Groups), and use alternate data, NBFCs reduce transaction costs and delays — two major obstacles for many seeking rural credit from traditional banks. For instance, in FY 2024–25, fintech NBFCs sanctioned approximately 10.9 crore personal loans amounting to ₹1,06,548 crore, a scale that has brought formal financial access to many who previously depended on informal sources.

NBFCs + Microfinance: A credit accelerator

Microfinance NBFCs (NBFC-MFIs) are a fundamental source for supplying credit to small borrowers. As of 30 June 2025, the microfinance industry’s outstanding portfolio stood at about ₹3.07 lakh crore, supporting some 10 crore active loans with around 6 crore unique borrowers — many in rural areas with limited formal credit options. Moreover, in FY 2024–25, nearly 80% of microfinance loan books of NBFCs were from rural India, indicating a strong shift toward serving underserved borrowers.

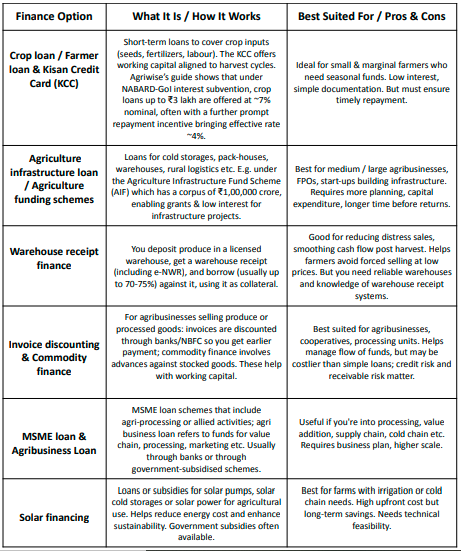

Product innovation & improved quality of rural credit

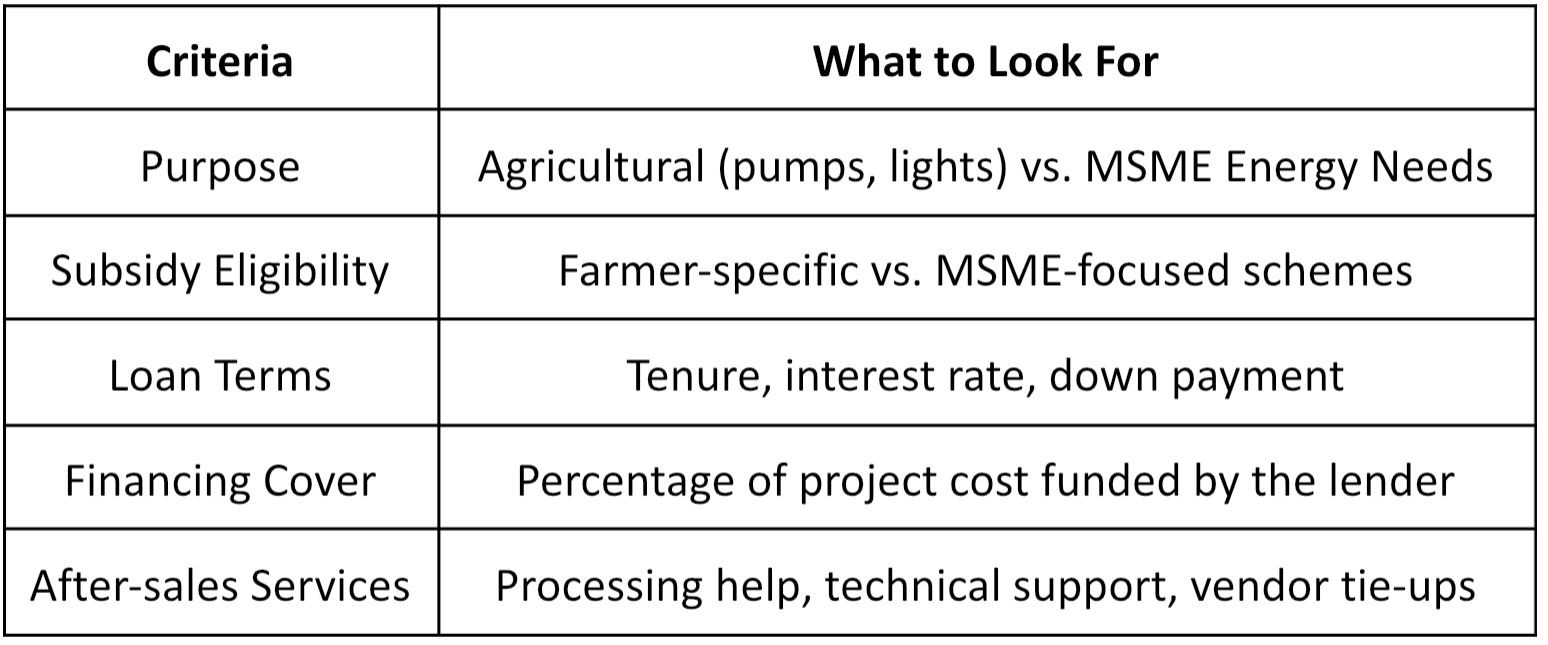

NBFCs are not just increasing reach — they are improving the type of rural credit on offer. Examples of innovations include small-ticket credit for crop inputs, loans against warehouse receipts, pump-set financing, seasonal working capital aligned with harvest cycles, and two-wheeler financing for last-mile connectivity. NBFCs are also shortening approval times through remote onboarding and leveraging mobile or digital payments.

Partnership models are also key: NBFCs are co-lending with banks, entering into ATL (Agri Term Loan), WHR , FPO Financing, Cattle Financing with agri-firms, and working with FPOs/SHGs to build trust and reduce risk. These models help tailor credit products in rural areas that reflect local crop cycles, rainfall variability, and seasonal incomes.

The broader context: Institutional credit & NBFC opportunity

Institutional credit to agriculture has more than doubled since 2014-15. For 2024-25, the official target for agri-credit was set in the range of ₹25-28 lakh crore, showing that government policy recognises the need for scale. NBFCs and MFIs are well-positioned to complement this push by reaching borrowers in areas with limited bank presence.

In regions where banks are sparse, NBFCs drive credit access; for example, the fintech NBFCs’ disbursals of over ₹1,06,548 crore via 10.9 crore personal loans in FY 2024-25 have helped many rural households move into the formal financial system.

Challenges & regulatory considerations

Scaling rural credit via NBFCs is not without challenges. Rural lending is exposed to climatic risks, commodity price fluctuations, and uncertainty in repayment cycles. NBFCs often face higher funding costs than banks, which may raise interest rates for borrowers. Ensuring consumer protection and transparent terms is essential, particularly for new borrowers with limited financial literacy.

Regulators have begun addressing these through co-lending guidelines, district-level credit plans (PLPs), and efforts to extend grievance redressal channels in rural areas. The goal is to ensure that rural credit remains accessible, affordable, and does not lead to overindebtedness.

The way forward: Scaling responsible rural credit

To build on the gains so far, NBFCs should:

- Deepen partnerships with NABARD, banks, FPOs, and SHGs for last-mile delivery.

- Use data-driven underwriting (e.g., using satellite imagery, payment histories, supply chain flows) to better assess risk in rural settings.

- Offer bundled services — insurance, crop advisory, and digital payment/income smoothing tools — to improve borrower resilience.

- Align loan tenors and repayment schedules with seasonal rural income flows so that credit is not burdensome during lean periods.

With rural areas contributing about 80% of NBFC microfinance loan books in FY 2024-25, and with the microfinance portfolio outstanding at ₹3.07 lakh crore supporting 10 crore loans, NBFCs are clearly playing an expanding role in formalising rural credit delivery. If these efforts are guided by responsible lending, NBFCs like Agriwise Finserv can help transform how rural India accesses finance — enabling innovation, investment, and sustainable growth.