If there’s one thing the Indian agriculture sector has been transforming over the past decade, it’s access to finance Today, business loans for agribusinesses are no longer limited to large enterprises or traditional crop loans They’re powering everything from farm mechanisation and storage to agri-startups and value-chain businesses And the numbers tell a compelling story Agricultural...

India’s farms are growing smarter, markets are moving faster, and finance is evolving alongside them Today, access to the right credit at the right time can shape everything, from crop decisions to trading opportunities and long-term expansion As institutional lending continues to expand, loans in India are becoming more digital, structured, and aligned with real agricultural needs The...

In an increasingly complex agricultural economy, navigating top finance decisions has become just as critical as choosing the right crop or season to sow Rising input costs, volatile market prices, and tighter credit access are reshaping how farmers manage their finances, and even small financial missteps can quietly erode profitability An allocation of INR 163 lakh crore for agriculture...

In agriculture, uncertainty is the only certainty From unpredictable weather patterns to fluctuating input costs and volatile commodity prices, farmers worldwide face financial pressures every season In India, particularly, farmers are witnessing input costs rising faster than their income, a trend that puts profit margins under significant strain Effective financial planning can make the...

The money arrives late The paperwork never ends And just when the crop cycle demands flexibility, the farm loans refuse to bend This is the lived reality of many farmers with farm loans in India On paper, agricultural credit has ballooned In reality, many farmers still grapple with credit that is mis-timed, mis-priced, and misaligned with what modern agriculture actually...

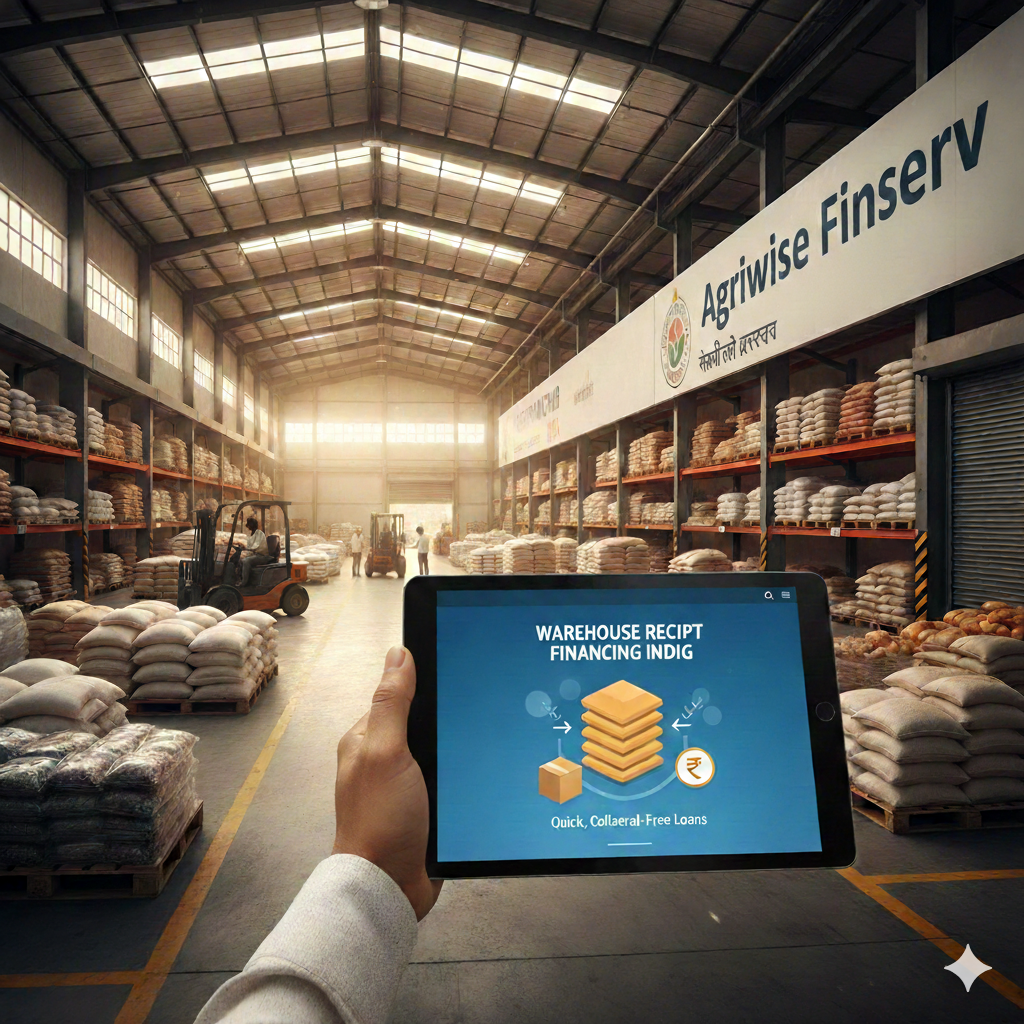

Did you know that the crops sitting in a warehouse could actually earn you money before they’re even sold That’s the power of Warehouse Receipt Financing Financial institutions are expected to meet the agriculture credit target of Rs 325 lakh crore for 2025–26 By turning stored produce into collateral, farmers and agri-traders can access instant credit, avoid distress sales, and even sell...

What if the key to transforming your farm’s profits this year isn’t just better seeds or machinery, but the types of financial options According to NABARD projections, agricultural credit extended by commercial and regional rural banks is expected to exceed ₹325 lakh crore in FY26, a new record for institutional credit flow in the sector In 2026, Indian farmers have access to types...

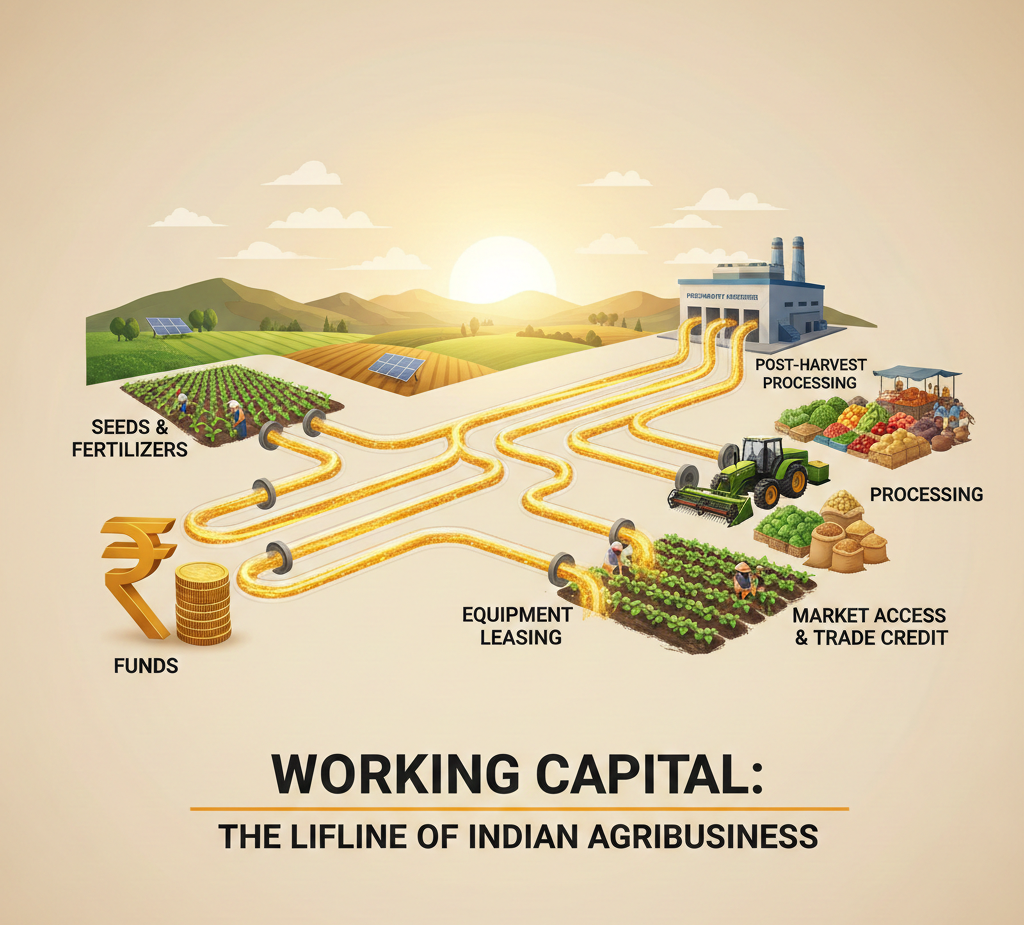

Indian agribusiness is entering a pivotal phase of financial transformation With agricultural credit forecasted to hit a record ₹325 lakh crore in FY26, up from ₹287 lakh crore in FY25, access to credit, especially working capital, is becoming more abundant and more critical than ever before This surge in financing is helping farmers and agri-enterprises modernise operations, invest in...

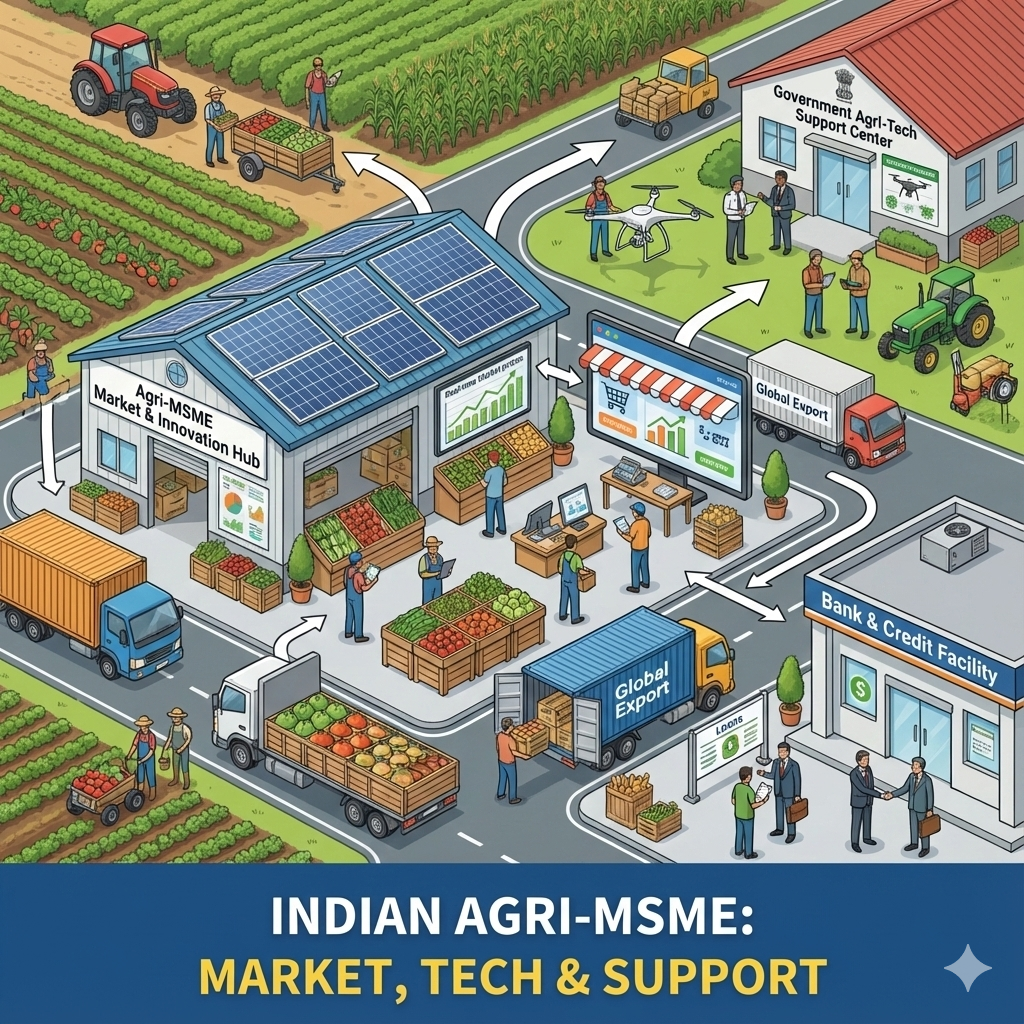

Indian agricultural MSMEs are demonstrating strong resilience and adaptability in the current dynamic economic landscape With greater access to markets, technology, and institutional support, these enterprises are well-positioned for sustainable growth Strengthening cash flow practices allows them to convert this potential into performance, ensuring liquidity, continuity, and confidence across...

Adopting solar irrigation is not just an eco-friendly choice but a practical way for farmers to reduce diesel and electricity costs, ensure reliable irrigation, and access attractive government subsidies and finance India’s solar water pump market was valued at USD 11268 million in 2024 and continues to grow rapidly Looking forward, it is expected that the market will reach USD 22154...

As Indian agriculture modernises, choosing the right finance options determines whether a farmer merely survives or grows In FY2024–25, institutional agricultural credit disbursements rose sharply, reaching around ₹287 lakh crore against the government target, reflecting stronger formal lending to the sector Against the prior year’s ₹2548 lakh crore disbursed in FY2023–24, this shows...

Taking a Loan Against Property (LAP) is one of the most cost-effective ways for farmers, agribusiness owners, MSMEs and SMEs to access large amounts of working capital But many applicants lose time, money, or approval chances because they stumble over basic checks when assessing a loan against property eligibility Below are 5 common mistakes and how to avoid them, so your application (and your...

Choosing the right agri finance partner can shape the entire farming journey from timely sowing to profitable harvesting As of 2025, India’s agricultural credit ecosystem has grown significantly, with institutional farm credit crossing ₹18 lakh crore annually and Kisan Credit Card (KCC) coverage extending to over 77 crore farmers With more formal lenders entering rural markets, farmers now...

As more farms turn to clean energy, solar finance has become a vital tool that helps farmers install solar pumps, rooftop systems, and field-mounted arrays without large upfront costs This guide breaks down how solar finance works in practical steps and highlights why it’s an attractive option for small and medium farmers in India today Why is solar finance important for farmers Solar finance...

In Indian agriculture, agri FinTech is emerging as a transformative force, reshaping the way farmers and value-chain stakeholders access finance, manage risk, and scale operations With increasing digitization, the entry of digital agri loans, and the rise of AI in agri finance, the sector is on the cusp of a new era: Agri-fintech 20 At Agriwise Finserv, our commitment to enabling this change...

As India strives to boost agricultural output while protecting the environment, a new force is quietly reshaping the sector—green finance Could the future of farming lie not just in better seeds or machinery, but in smarter, eco-friendly funding With agriculture contributing nearly 18% to India’s GDP and supporting over 40% of the workforce, the potential impact of sustainable agri finance...

Agritech startups are reshaping how Indian agriculture works — from digital marketplaces and precision farming tools to alternative credit models and supply-chain traceability For farmers and MSMEs looking to partner with or benefit from these new players, understanding how agrifinance works and where to find reliable agri-financial services is essential Why funding matters for agritech...

Access to reliable rural credit is vital for India’s agricultural productivity, rural livelihoods, and inclusive growth In areas where commercial banks are scarce, Non-Bank Financial Companies (NBFCs) are rapidly emerging as critical providers of credit, adapting their models to meet the unique challenges of remote and small-scale borrowers Why NBFCs matter for rural credit NBFCs offer...

Sustainable agriculture is no longer a niche aspiration — it’s becoming central to how India funds its food future As climate risks, soil degradation, and market shocks intensify, financiers, policymakers, and farmers are shifting capital toward practices that increase productivity while protecting ecosystems This transition is evident in the rise of green debt markets, the expansion of...

For MSMEs operating in the agricultural value chain—whether input suppliers, aggregators, processing units, cold storage operators, or rural logistics providers—access to credit without requiring collateral is a game changer Collateral requirements often act as a barrier for smaller agribusinesses that lack land title or real estate In 2025, a growing number of collateral-free loan schemes...

In India’s agricultural economy, cash flow challenges are one of the biggest barriers for farmers, especially smallholders, in accessing inputs, waiting for good market prices, and avoiding distress sales Warehouse receipt finance (WHR finance) has emerged as a powerful tool to enable farmers to convert stored produce into working capital, improve bargaining power, and reduce risk But how does...

India’s agriculture is evolving rapidly, shaped by inflationary pressures, climate challenges, and shifting policy priorities Choosing the right finance options for your farm or agribusiness is now more crucial than ever This article highlights the leading agri finance solutions—what they offer, who benefits most, and how Agriwise helps you identify and access the right fit for your...

Agriculture and MSMEs across India are turning to renewable energy to cut costs, increase productivity, and achieve sustainability A solar loan allows farmers and small businesses to invest in solar energy systems—like rooftop solar, irrigation pumps, and other installations—without the hefty upfront cost Thanks to favorable interest rates, subsidies, and flexible repayment structures, these...

For agribusinesses seeking capital without compromising operational liquidity, a loan against property (LAP loan) offers a compelling solution An agri LAP loan leverages your existing property—be it farmland, warehouse, or residential premises—to raise funds, typically at lower interest rates than unsecured credit For those in the agriculture sector, LAP for farmers/agribusiness bridges the...

Choosing between an agri term loan and short-tenor working capital can decide how smoothly your season runs—and how quickly you scale India’s agricultural finance landscape is deepening According to PIB, as of March 2024, there were 775 crore operational Kisan Credit Card (KCC) accounts with ₹981 lakh crore outstanding, underscoring the centrality of short-term credit for input purchases...

According to The Economic Times, India’s Micro, Small, and Medium Enterprises (MSMEs) continue to be the backbone of the national economy, contributing roughly 30% to the country’s GDP while employing over 110 million people across diverse industries Yet, despite this massive footprint, MSMEs continue to face their biggest hurdle: timely access to working capital Delayed payments remain...

Agribusinesses require timely access to capital to expand, modernise, and stay competitive One of the most effective ways to raise substantial funds is through a Loan Against Property (LAP) By leveraging owned agricultural, residential, or commercial property, businesses can unlock the value of their assets without selling them With competitive loan against property interest rates and flexible...

In 2025, securing the right agriculture loan will be crucial for Indian farmers to thrive From crop loan schemes to MSME finance, solar loan for farmers, and agri business loan options, this guide from Agriwise helps you navigate the best agriculture loan options in India Agriculture loan landscape: Key figures & trends In FY 2024‑25, formal farm credit in India rose to...

As India’s agricultural landscape evolves, the demand for timely and structured financial solutions has never been greater In 2024–25, India’s agricultural credit target has been raised to ₹20 lakh crore, a strong policy signal aimed at ensuring liquidity for farmers through accessible and flexible crop finance Among the various funding options available, seasonal crop loans remain one of...

Rural finance has emerged as a key driver in transforming India's agrarian landscape in recent years Among these, agri-infra loans, also known as agriculture infrastructure loans, have catalysed the creation of vital rural assets—warehouses, cold chains, and processing facilities—that empower farmers to enhance their incomes, reduce post-harvest losses, and modernise their businesses These...

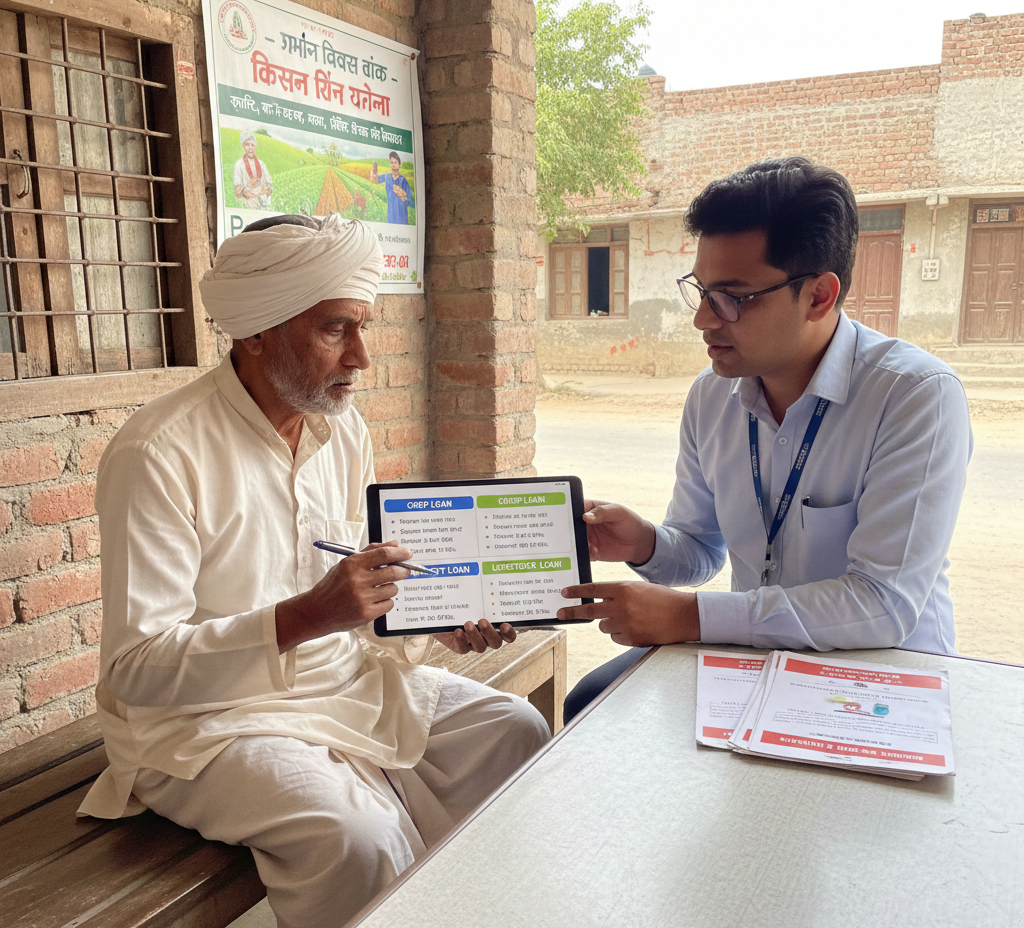

In a country where nearly 65% of the population resides in rural areas and agriculture sustains millions of livelihoods, financial literacy is no longer a luxury—it's a necessity The intersection of financial education and its impact on agri-finance, particularly agriculture loans for farmers, has never been more critical Without adequate financial knowledge, rural communities struggle to...

India's agri-MSME sector plays a vital role in supporting the agricultural economy, accounting for nearly 33% of total MSMEs in the country Despite this, over 80% of small agri-businesses face challenges in accessing timely and affordable credit, which hampers their ability to expand, invest in technology, and build resilient supply chains This is where supply chain finance (SCF) emerges as a...

Agriculture remains the backbone of India’s economy, employing over 50% of the nation’s workforce and contributing nearly 18% to the country's GDP Yet, farmers—especially smallholders—often face severe financial constraints in accessing quality inputs, mechanisation, storage facilities, and post-harvest services Recognising this, the Indian government has rolled out several targeted...

As India’s farming sector continues to modernise, agricultural finance is playing an increasingly crucial role in supporting rural livelihoods, enhancing productivity, and promoting sustainable growth The future of agri finance is being reshaped by digital technology, government schemes, and evolving credit models that are transforming how rural borrowers access capital From traditional...

Indian agriculture is undergoing a technological transformation, powered by agripreneurs and small rural enterprises An agri MSME loan, specifically for farming-related services such as processing, logistics, warehousing, and input distribution, is central to this evolution As of FY 2024–25, credit outstanding to MSMEs reached ₹313 lakh crore across 245 crore accounts, while agricultural...

As India marches toward becoming a $5 trillion economy, MSME finance and agribusiness continue to drive inclusive and sustainable growth With nearly 63 million micro, small and medium enterprises (MSMEs) contributing around 30% to India’s GDP, and agriculture employing over 50% of the workforce, both sectors demand innovative, tech-led financial solutions Agricultural credit in India is...

A warehouse receipt loan can be a lifeline for farmers, traders, and processors who need liquidity without having to sell their produce at suboptimal prices Agriwise Finserv, a trusted name in agri-focused lending, offers this facility as part of its commodity finance portfolio, providing short-term working capital against the value of agricultural stock stored in approved warehouses India's...

India's agriculture sector, a backbone of the country’s economy with almost 18% GDP contribution, remains highly vulnerable to climate risks such as droughts, floods, unseasonal rainfall, and pest infestations To safeguard livelihoods, crop insurance in India plays a critical role in minimising financial risks and helping farmers recover from crop loss India's crop insurance market is...

NBFCs refer to entities that are not banks but provide services such as lending and other activities without holding a banking license One of the main reasons why people choose NBFCs over banks is due to lower costs Since the need for finance in the farming community is on the rise, banks alone cannot cater to the increasing demand, so NBFCs provide finance to both the public and private sectors...

Agri Equipment Finance is a loan given to obtain business equipment that includes any tangible asset such as: farm equipment (except real estate) that would help borrowers boost farm produce, not having to worry about loan security It simply refers to a collateralized loan allowing farmers to purchase equipment, and once the loan is repaid, the borrower becomes the owner of that equipment At...

Agricultural loans are availed by a farmer to fund seasonal agricultural operations or related activities like animal farming, purchase of land or agricultural tools; A form of credit that can be secured as a personal loan by the borrower Agriwise provides these Agri loans to farmers with commercial or residential properties as collateral and the tenure lasts up to 8 years It is a Secured term...

Warehouse Receipt Finance is a process where a financer provides credit to a seller against the security of goods stored in the warehouse It includes the assurance of the commodity's quality and quantity within an approved facility While simple in concept, a warehouse-receipt system requires the availability of safe warehouses and widely accepted commodity grades and standards Further, it is...

Agriculture is the backbone of the Indian economy and therefore the problems faced by this industry have been crucial topics of discussion The uncertain nature of this industry results from a number of reasons including: Poor infrastructure & farming techniques, low use of farm technologies etc, ultimately resulting in low productivity Consequently, the emergence of digital agriculture- a...

The Indian Agri-credit system has made commendable progress with the enforcement of some major policy changes over the years Credit supply is one of the most integral determinants of investments in agriculture due to the degree of uncontrolled production and price risk that can influence the industry which makes the progress of Agri-credit systems more crucial than ever Policy changes have...

The PM Kusum Yojana was introduced by the central government in 2019 Under this scheme, the central government of India will provide Kusum solar pump sets on a subsidised basis These solar pumps have two purposes: They help farmers with irrigation and allow them to generate electricity The government will provide a subsidy of 60% to farmers and 30% of the cost will be given by Government in form...

Priority sector lending (PSL) was formalized in 1972, and RBI advised PSL targets to banks in 1974, which ensures that the lenders compulsorily lend 40% of their total credit to specific sectors The Reserve Bank of India (RBI) has defined different categories under priority sector and agriculture is one of that category which falls under priority sector lending Domestic scheduled commercial banks...

Agri financing plays an essential role in farm sector development, as India being an agrarian economy is a major contributor to the global food basket As on March 31, 2020, NBFCs had total assets of Rs 5147 trillion, almost 25% of India’s GDP Therefore, a healthy NBFC sector from a systemic point of view is crucial for India’s economic revival The recent RBI bulletin released in May 2021...

The Indian agriculture market is estimated to be worth INR 18,367 billion (2019) Currently, India ranks within the world’s five largest producers of over 80% of agricultural items, including many cash crops Easy availability of credit is a major driver of the Indian agriculture industry Many farmers and agribusinesses do not have access to timely and suitable credit leading to lower production...

The agriculture sector contributes significantly to the Indian economy in terms of revenue and employment It makes for around 16% of the Indian GDP and 4149 percent of the workforce employment But farming and related commercial activities are tough It requires labour, supplies, land, and equipment It also faces risks like vagaries of weather, shrinking farm sizes and pest infestation Limited...