India’s agriculture is evolving rapidly, shaped by inflationary pressures, climate challenges, and shifting policy priorities. Choosing the right finance options for your farm or agribusiness is now more crucial than ever. This article highlights the leading agri finance solutions—what they offer, who benefits most, and how Agriwise helps you identify and access the right fit for your needs.

Why does good agriculture finance matter?

Agriculture contributes about 16% of India’s GDP (as of FY 2024-25) and supports nearly 46% of the population. Yet one of the challenges remains access to sufficiently tailored agriculture credit or agriculture loan schemes, especially for smallholders. If you choose wrong, cost of capital drains profit; if you choose right, it can boost productivity, reduce risk, and raise incomes.

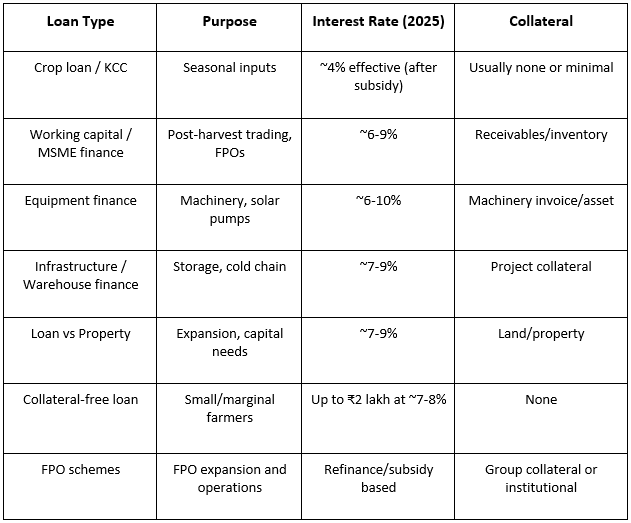

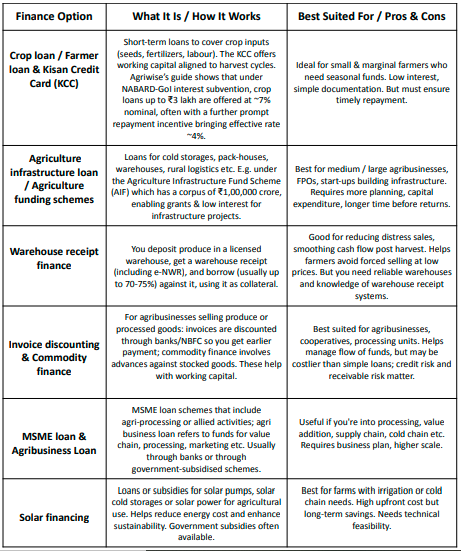

Key finance options available in India

Here are the main types of finance options you can consider, depending on your agribusiness size, purpose, and risk profile.

Other supportive elements: subsidy, working capital, policies

- Agricultural subsidy schemes like input subsidy, fertilizer subsidy, electricity subsidy for pump sets etc still form part of farm finance. These reduce the effective cost of agriculture finance.

- Agricultural working capital loans cover ongoing costs; many agriculture loan schemes provide for working capital (via KCC, crop loans, or MSME lines).

- Government schemes like Pradhan Mantri Fasal Bima Yojana (PMFBY) provide risk coverage for crops. Budget 2025-26 allocated ₹69,515.71 crore from 2021-22 to 2025-26 for PMFBY & Restructured Weather Based Crop Insurance Scheme.

Choosing the right finance option

To decide among finance options, consider:

- Your financial need: Are you funding inputs for one crop cycle (short-term), investing in infrastructure, or managing working capital for processing?

- Your business entity & scale: Small/marginal farmers vs Farmer Producer Organisations (FPOs) vs agribusiness/processing firms.

- Collateral and risk: Do you have collateral (Commodity, fixed assets), or only produce receivables? What risk are you taking (price, weather, market)?

- Cost of finance: Interest rate, fees, moratorium, repayment schedule. Subsidised rates (crop loan, KCC) vs more commercial rates (invoice discounting, MSME).

- Support & guidance: Navigating documentation, schemes, subsidies etc.

Agriwise offerings that help

At Agriwise, we offer services/products aligned to these finance-options to ease your journey:

- Tailored agribusiness loan advisory: We help assess which agriculture loan or agribusiness loan suits your scale and purpose.

- Assistance in obtaining crop loan: guiding documentation, eligibility, repayment options.

- Facilitation of warehouse receipt finance: identifying licensed warehouses, helping you pledge produce to get credit.

- Support for MSME loan applications and invoice discounting arrangements for agribusiness clients.

- Linking farms with solar financing and subsidy programmes to reduce operational cost and enhance sustainability.

Summary: Which finance options suit your agribusiness?

- If you are a small or marginal farmer needing funds for one crop cycle → crop loans / KCC / farmer loan with subvention or subsidy, low cost.

- If you are selling produce post-harvest and need liquidity → warehouse receipt finance, avoid fire-sale prices.

- If you’re an agribusiness/processor needing working capital for receivables or raw material input → invoice discounting / commodity finance / MSME loan.

- If you’re building storage, cold chain or value-addition infrastructure → agriculture infrastructure loan under AIF or similar.

- If you want to reduce recurring input cost / energy cost → solar financing + subsidy.

Conclusion

There is no one-size-fits-all when it comes to agriculture finance. The best finance options depend on your operations, cash flow, scale and risk appetite. With the right mix of agriculture credit, helpful agricultural subsidy support, and working with providers who understand the sector, your agribusiness can grow sustainably.

Agriwise is here to help you pick, apply and manage the right mix of agriculture loan, agribusiness loan, working capital, and funding solutions so your farm not only survives, but thrives.

Disclaimer

The content published on this blog is provided solely for informational and educational purposes and is not intended as professional or legal advice. While we strive to ensure the accuracy and reliability of the information presented, Agriwise make no representations or warranties of any kind, express or implied, about the completeness, accuracy, suitability, or availability with respect to the blog content or the information, products, services, or related graphics contained in the blog for any purpose. Any reliance you place on such information is therefore strictly at your own risk. Readers are encouraged to consult qualified agricultural experts, agronomists, or relevant professionals before making any decisions based on the information provided herein. Agriwise, its authors, contributors, and affiliates shall not be held liable for any loss or damage, including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from reliance on information contained in this blog. Through this blog, you may be able to link to other websites that are not under the control of Agriwise. We have no control over the nature, content, and availability of those sites and inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them. We reserve the right to modify, update, or remove blog content at any time without prior notice.